Pursuant to Internal Revenue Code (IRC) Sections 1446(a) and 1446(f) of the US Internal Revenue Service (IRS), from January 1, 2023, holdings, trading, or transfers of Publicly Traded Partnership (PTP) securities by a non-US person shall be subject to the following withholding tax:

● Sales, trading, or transfers of PTP securities shall be subject to a withholding tax equal to 10% of the transaction amount;

● Dividends from PTP securities shall be subject to a withholding tax equal to 37% (applicable to individual investors) or 21% (applicable to companies or institutional investors) of the dividends.

● Exemption from withholding may apply if a PTP releases a public statement called a "Qualified Notice" to indicate that the PTP meets the requirements of IRC Sec. 1446(f)-4(b)(3) to be exempt from withholding.

Considering the complexity of withholding tax, Moomoo SG has decided to make the following trading arrangements (which may be adjusted from time to time based on the latest developments):

● From December 5, 2022, we will stop accepting transfers of PTP securities into Moomoo SG. You can still transfer PTP securities out of Moomoo SG without transfer fees. View more instructions via the link: https://www.moomoo.com/sg/support/topic5_400

● From December 12, 2022, opening positions in PTP securities will not be supported.

● From December 26, 2022, closing positions in PTP securities will not be supported, with the last trading day being December 23, 2022.

● From December 26, 2022, opening or closing positions in PTP securities or options will not be supported, with the last trading day being December 23, 2022.

References:

IRS Requirements on PTP Products:

https://www.irs.gov/individuals/international-taxpayers/publicly-traded-partnerships

IRS Regulations on the Withholding Tax on PTP Transactions:

https://www.irs.gov/individuals/international-taxpayers/partnership-withholding

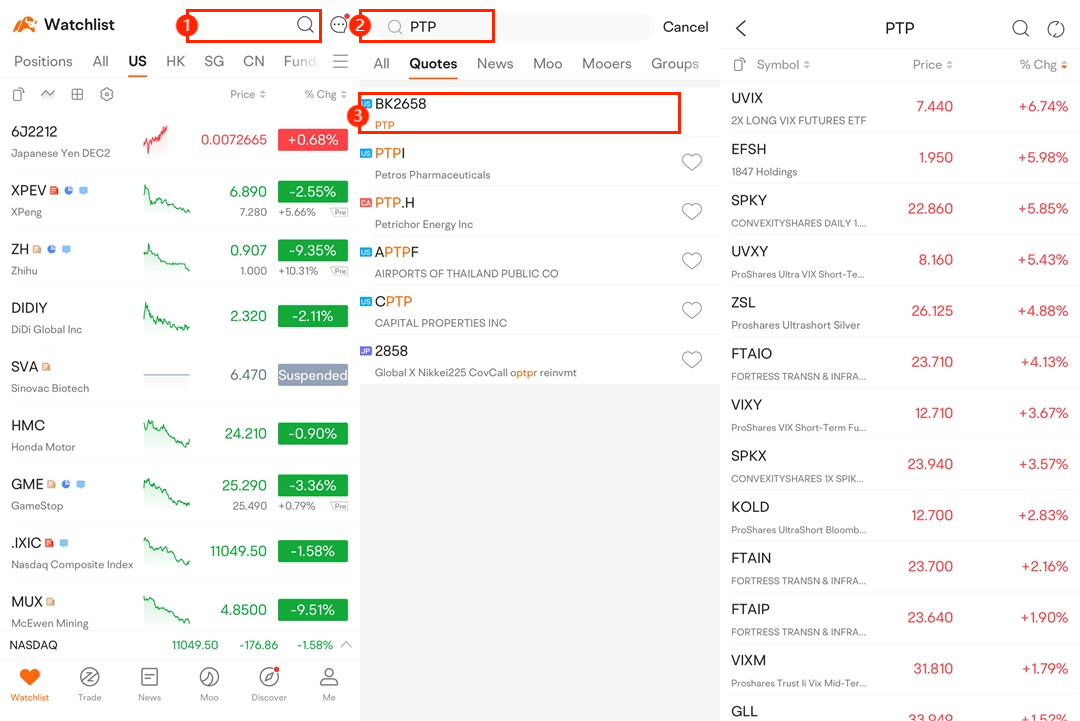

You can find PTP securities by

● List of PTP Securities

● searching results on the moomoo app

List of PTP Securities:

This list identifies PTP securities which will be subject to withholding under IRC Sec. 1446(f) unless a "Qualified Notice" exemption is applicable at the time of the sale.

| NO. |

SYMBOL |

| 1 |

AB |

| 2 |

AGQ |

| 3 |

AHOTF |

| 4 |

ARLP |

| 5 |

BBU |

| 6 |

BDRY |

| 7 |

BEP |

| 8 |

BEP.PRA |

| 9 |

BEP.PRR.TO |

| 10 |

BEPPRG.TO |

| 11 |

BEPPRM.TO |

| 12 |

BEPPRO.TO |

| 13 |

BIP |

| 14 |

BIP.PRA |

| 15 |

BIP.PRB |

| 16 |

BIPPRA.TO |

| 17 |

BIPPRB.TO |

| 18 |

BIPPRE.TO |

| 19 |

BIPPRF.TO |

| 20 |

BITW |

| 21 |

BNO |

| 22 |

BOIL |

| 23 |

BPYP.PRA.TO |

| 24 |

BPYPM |

| 25 |

BPYPN |

| 26 |

BPYPO |

| 27 |

BPYPP |

| 28 |

BRENF |

| 29 |

BSM |

| 30 |

BWET |

| 31 |

CANE |

| 32 |

CAPL |

| 33 |

CHKR |

| 34 |

CLMT |

| 35 |

CORN |

| 36 |

CPER |

| 37 |

CQP |

| 38 |

DBA |

| 39 |

DBB |

| 40 |

DBC |

| 41 |

DBE |

| 42 |

DBO |

| 43 |

DBP |

| 44 |

DEFI |

| 45 |

DKL |

| 46 |

DMLP |

| 47 |

ECTM |

| 48 |

EFSH |

| 49 |

EPD |

| 50 |

ESBA |

| 51 |

ET |

| 52 |

ET.PRC |

| 53 |

ET.PRD |

| 54 |

ET.PRE |

| 55 |

ET.PRI |

| 56 |

EUO |

| 57 |

FGPR |

| 58 |

FGPRB |

| 59 |

FISK |

| 60 |

FUN |

| 61 |

GBLI |

| 62 |

GDVTZ |

| 63 |

GEL |

| 64 |

GHI |

| 65 |

GLL |

| 66 |

GLP |

| 67 |

GLP.PRA |

| 68 |

GLP.PRB |

| 69 |

GRP.U |

| 70 |

GSG |

| 71 |

GYRO |

| 72 |

IEP |

| 73 |

KOLD |

| 74 |

MDBH |

| 75 |

MMLP |

| 76 |

MNR |

| 77 |

MPLX |

| 78 |

MPLXP |

| 79 |

NEN |

| 80 |

NGL |

| 81 |

NGL.PRB |

| 82 |

NGL.PRC |

| 83 |

NRP |

| 84 |

NS.PRA |

| 85 |

NS.PRB |

| 86 |

NS.PRC |

| 87 |

NSLPQ |

| 88 |

OAK.PRA |

| 89 |

OAK.PRB |

| 90 |

OGCP |

| 91 |

OZ |

| 92 |

PAA |

| 93 |

RSTRF |

| 94 |

SCO |

| 95 |

SDTTU |

| 96 |

SMLP |

| 97 |

SOYB |

| 98 |

SPH |

| 99 |

SPLP |

| 100 |

SPLP.PRA |

| 101 |

SUN |

| 102 |

SVIX |

| 103 |

SVXY |

| 104 |

TAGS |

| 105 |

TXO |

| 106 |

UAN |

| 107 |

UCO |

| 108 |

UDN |

| 109 |

UGA |

| 110 |

UGL |

| 111 |

ULE |

| 112 |

UNG |

| 113 |

UNL |

| 114 |

USAC |

| 115 |

USCI |

| 116 |

USDP |

| 117 |

USL |

| 118 |

USO |

| 119 |

UUP |

| 120 |

UVIX |

| 121 |

UVXY |

| 122 |

VIXM |

| 123 |

VIXY |

| 124 |

VPRB |

| 125 |

WEAT |

| 126 |

WEIX |

| 127 |

WES |

| 128 |

WLKP |

| 129 |

YCL |

| 130 |

YCS |

| 131 |

ZSL |

You can also find the List of PTP Securities by searching on the moomoo app.

Disclaimer:

It is not an exhaustive list of all PTP securities that are in scope for Section 1446(f). The list may be subject to change from time to time without prior notice. If the sale of security (from 1 January 2023 onwards) is not listed in the provided PTP list but falls under PTP classification, Moomoo SG reserves the right to claim the withholding tax from you to satisfy IRS withholding requirements.

If you hold PTP securities or derivatives, we would advise you to consult tax advisors on the potential impacts and trading arrangements.